Earnings Season 6/5/23

In this issue.

Salesforce- You tell me the name of a sales rep who loves using this platform, and I’ll tell you the name of a liar. The SAAS Uber Juggernaut previously announced a flight to quality enterprise clients. Are they seeing results yet?

CrowdStrike— If any Crowd Strike execs are reading this, I live in Austin and I too love Mercedes F1 racing. Crowdstrike, the cyber security leader, has had some exceptional growth in recent years. Are they keeping up with the market?

Nordstrom—The nicest store in the mall released their earnings last week. How is the upper end of consumer retail fairing?

lululemon- The first time a friend wore a pair of that “women’s brand” ABC pants, I raised an eyebrow. Many years and I don’t know how many pairs later, I can say he was right—they are perfect. Now, they face competition from every angle. Are they keeping up, or falling by the wayside?

In every issue:

● What happened this week

● What's happening next week

● Government Data Release calendar

-Chris Schaum

Thanks to our sponsor:

CEO's and COO's- Are you sick of your sales and marketing teams lacking the financial knowledge they need close the deals you need to hit your bonus's? The Million Dollar Dealmaker Toolkit will teach your teams everything they need to know about finance and project management in less than 3 hours so they can present your products as investments, not line items. Guaranteed or your money back.

The highlights:

SalesForce: $208B market cap beat earnings by 8 Cents.

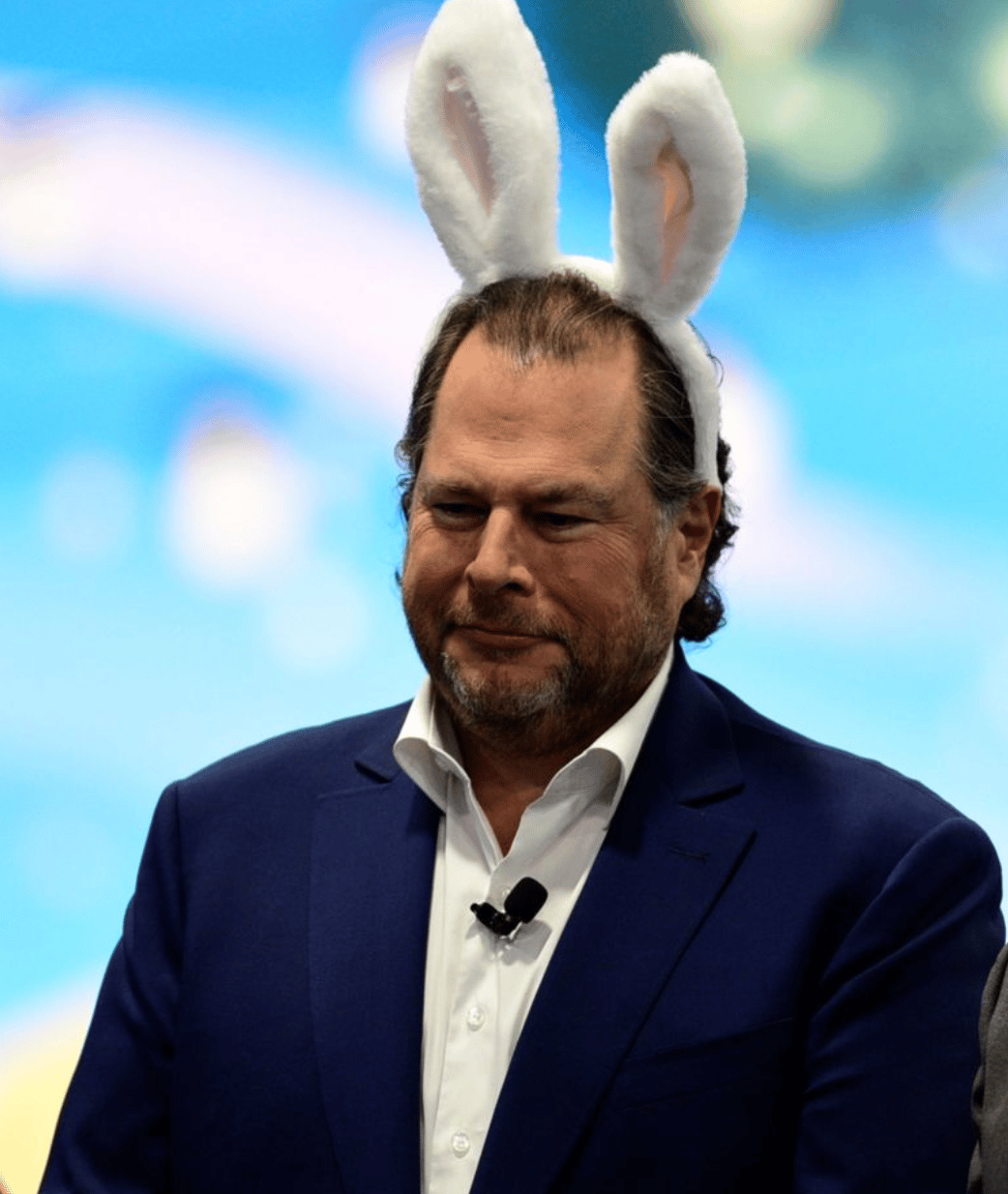

Why we care: Last quarter, Marc Benioff told the world they were going to hit the hyperspace button at their company. At its core, this is all about profitability. Salesforce had $8.2B which was 11% growth—BUT their operating margin grew 27.6%.

It shouldn’t surprise you that Salesforce, like everyone else, is focused on generative AI. This is lengthier, but if you are interested in the opportunities for LLM’s (Large Language Models) to be run by big businesses, Marc has a really powerful story.

We can also learn from Brian Millham, Salesforce COO, on how they are handling what they call a "constrained" environment:

If you are competing with Salesforce… It’s important to note that one of their big efficiency plays is to make the bottom end of the market self service. Some customers will love that, others will not. Which will create a huge opportunity for competitors.

Keep an eye out for Salesforce to continue their mission to eat the middle market competition by consolidating opportunities. More on this later in the newsletter…

Crowd Strike: $35B market cap 17 cent per share loss.

Consolidating influence and power inside your customers business is the goal of many large enterprises. I just referenced it with Salesforce. It has been one of the big themes since the shift in the economy. Crowd Strike is using this same playbook successfully. George Kurtz is highlighting this very thing here:

“I think I'll start with consolidation and I'll reference back to what I spoke about in the prepared remarks. Every customer that we spoke to and I spoke to many, many customers at RSA. And even throughout the quarter, it was really about consolidation. I think we've done a good job of showing a very cost-compelling model for them where they're actually paying less than [indiscernible] for the security pieces particularly CrowdStrike and they are getting better outcomes. So there are many customers that have said, we want to consolidate on CrowdStrike.”

In assessing strategies, consolidation is nothing new. However, the economic situation is creating some fear for customers that their suppliers may not be able to support them long- term. This could end up being a self-fulfilling prophecy as more established businesses push to take advantage of the situation. If you have the financial strength, why not bolt on your competitors' products, even if they are loss leaders?

While this strategy is working, there are some significant challenges. First— contract terms are dropping. Historically, Crowd Strike has done many multi-year deals. Burt Podbere highlighted this on their earnings call. So if you are seeing contracts shorten in length, you are not the only one. If you’re in sales or leadership, you’ll want to take note of this customer trend.

Nordstrom: $2.82B market cap: 7 cent beat. Investors thought they would lose money.

Name a more iconic and fashionable movie. I’ll wait

Nordstom is a tale of two cities—Nordstom and Nordstom Rack. As of late, Rack has been the primary focus on the executive leadership team. This strategy makes sense with the shifting economy. They are relatively cheap compared to their luxury-based sibling, and they offer a bottom up strategy. To put it in sales lingo… They are a profitable top of the funnel.

At Nordstrom stores, the designer categories are having the hardest time. Specifically, the higher-end customers are not spending as much.

Pete Nordstrom, CEO said “with the high-end customer, I guess we would say they are pretty resilient. But they are all so cautious and that — we’re seeing that really across the board that caution. “

Lastly, it was insightful that Nordstrom is essentially shelving their private label (Nordstrom brand or unbranded clothing) brands at the Rack store. While customers are looking to save money, spending less, rather than disappearing… brand is still top of mind for the consumer.

Lululemon- $46B market cap. 31 cent earnings beat.

If you’re a woman, or have some in your household, you may have seen these little Lululemon fanny packs around your home. You are not alone. Accessory item sales grew 64% year-over-year at Lulu, leading a staggering 24% overall sales growth.

Lulu has pulled off three other impressive things we can learn from:

Community and Data- Lulu launched a free “community” program about 8 months ago. They smartly realized that increasing net revenue retention is about more than just a loyalty card.

Calvin Mcdonald said: “Through this free-to-join program, we gain deeper knowledge on how our guests like to sweat and what aspects of our brand are most meaningful to them.We can leverage the data and insights to help develop future activations and invite them to the events that are most relevant to them and inform our product pipeline with opportunities around unmet needs. Our stores are an integral part of this ecosystem, as they provide connection points within local communities across the world and serve many purposes, including allowing our guests to interact with our educators, to learn about our products, the technical innovations that can be found within our assortment and the unmet needs they solve.”

Gun buy backs—Sorry *dupe buy backs* Lulu has accepted the same premise of the late Virgil Abloh of Louis Vuitton and Off White. Counterfeit and duplicate products are going to exist, and they are a sign of your strength and success. But they took it one step further, offering multiple opportunities for their customers to trade in their dupe leggings for the genuine thing at their stores. The results were astounding! Mcdonald said “It generated more than 1 billion earned media impressions and was covered by national and international media outlets in addition to creating viral social media buzz. About 50% of the guests who traded in dupes are new to our brand. Approximately half of the guests who attended, some of whom started waiting in lines as early as 3 a.m., were under 30 years old. And while I won't get into specifics, the leggings that guests traded in ran the gamut in terms of brands and price points.”

Any business can learn a lot from Lulu. If attention is everything, what can you do to control more of it? It doesn’t all have to be about revenue, either. Lulu doesn’t directly tie revenue to hosting events at their locations or referring people to exercise opportunities, but revenue happens.

Attention, community, and activation are three themes every business needs to be thinking about.

Data Releases.

Why we care: While alternative data is on the road to taking over, nothing moves the market like government and stalwart financial data. Understanding this data can help craft your messaging and deals.

June 5: Durable Goods

June 7: 30yr Mortgage Rates, Consumer Credit

June 8: Initial and Continuous Jobless Claims

June 13: Core CPI

Examples of ways to use this info:

● Set up a 5 min call with your clients and prospects. "Susan—can we chat for 4-6 minutes? I read about the how Nvidia is forecasting a 1 trillion dollar 10 year data center turn over and thought it might be of interest to you”

● Cold email: Subject: "What do you think about Lululemons "Gun" Buyback strategy?" Body— John, Last week Lululemon released earnings. They talked about their dupe buy back program. Their goal was to get all the counterfeit Lulu off the streets We've seen some out of left field strategies our clients use drive massive revenue. Can we chat for 4-6 minutes to see who this might be valuable to?

● Meeting with your boss: a lot of big tech like SalesForce and Crowd Strike are focused on multi-lining and consolidating product lines with their customers and heading up market, I have some ideas on how we can use this to our advantage.

● Call with a client: "Kenny- did you see the unemployment rate this week? They came in at X. Are you seeing that in your market?"

● Linkedin Posts: 3 ways Nordstrom is diversifying their revenue. Put on some new lipstick, it’s time to pucker up for investors.

● Forward them the newsletter!

Thanks for reading!

If you have a tip or feedback, I’d love to hear it.

All views are solely my own.